The year began with one new healthcare transparency rule already in effect and others slated for implementation into 2024. The enforcement timeline has changed slightly, but it shouldn’t delay employer-sponsored health plans from preparing for the Transparency in Coverage rule.

They have too much to gain, and now more time to get it right.

Not So Fast

The Transparency in Coverage rule was proposed prior to the pandemic and became final in the middle of it. The basic requirements for group health and employer-sponsored plans are to:

- Make public, among other data, the in-network rates, out-of-network allowed amounts and billed charges, and historical prescription drug prices in three machine-readable files by January 2022.

- Provide out-of-pocket cost estimates for 500 shoppable items and services in an internet-based, self-service tool for members, in addition to in-network rates and out-of-network allowed amounts. Deadline: January 2023.

- By January 2024, cost estimates, in-network rates, and out-of-network allowed amounts for all covered items and services, including prescription drugs, must be available in the self-service tool.

Too much too soon, perhaps? Some industry groups claim so.

A related Hospital Price Transparency rule took effect January 1 of this year. Fewer than 6% of hospitals have complied as of late summer. Although the Centers for Medicare and Medicaid Services (CMS) proposes to increase the maximum potential fine for noncompliant hospitals, for now, CMS will not fine noncompliant hospitals and expects voluntary corrective actions. The industry asked for more time, and CMS granted it for now.

What Now?

What do recent developments mean for group health plans subject to the Transparency in Coverage mandate? Federal agencies have already extended the compliance deadline for posting machine-readable files to July 1, 2022. So far that’s the only deferment.

In response to the delay, the U.S. Chamber of Commerce dropped its suit to block the rule, but a separate suit from the Pharmaceutical Care Management Association (PCMA) to block the display of prescription drug machine readable files is still pending as of this blog’s posting date.

Time will tell what compliance and enforcement look like next year. However, given how two seemingly polar-opposite administrations put their weight behind the rule, and that stiff excise taxes for noncompliance are still on the books, price transparency requirements likely aren’t going away.

Nor should they, especially if you’re a self-insured employer.

More Gain Than Pain

The path to Transparency in Coverage compliance can appear daunting, for sure. But the benefits can be more than worth the journey, at least with respect to pharmacy costs.

Big picture wise, visibility into what other group plans pay for prescriptions could help employers seek better deals for their plan and members. That may well create pricing pressures that help bring down costs across the board.

The more predictable and immediate impact is informed, empowered plan members. Our experience in pharmacy transparency has shown us the manifold benefits:

- Employees and dependents make more cost-efficient choices on available therapies.

- They lower their out-of-pocket burden and the plan’s pharmacy spend.

- They’re more engaged with their pharmacy benefit, and with health benefits in general.

- They’re more adherent to medication.

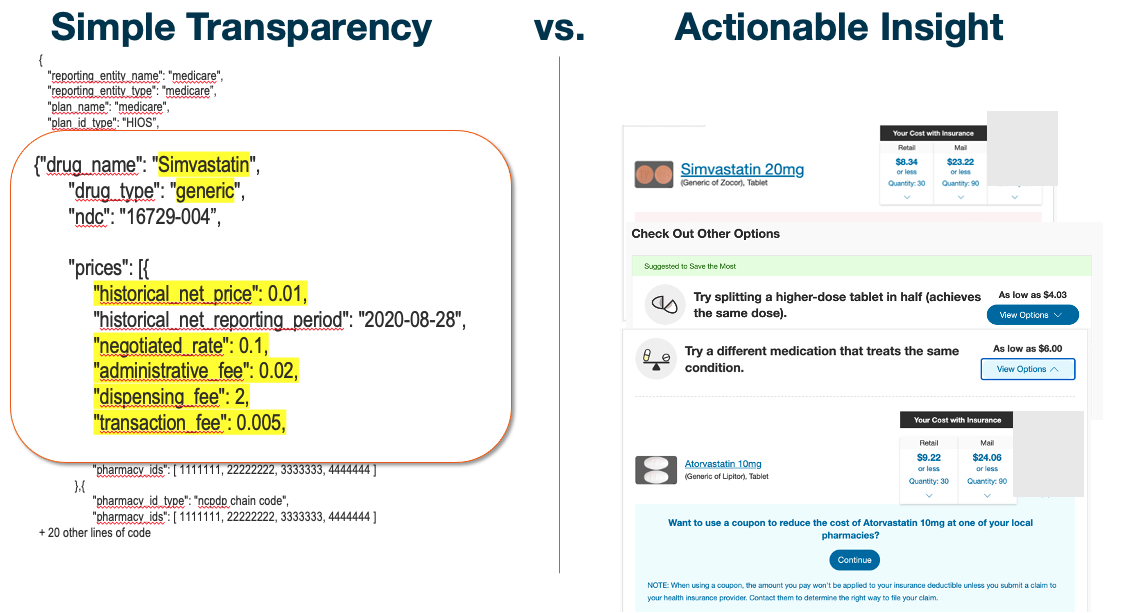

Plan members don’t get this way simply by accessing machine-readable files or clicking through 100-page PDFs and figuring things out for themselves. The information needs to be packaged in a meaningful, actionable way.

The above visual shows the marked difference between raw data in a typical machine-readable file and the same information presented in empowering fashion. On the right, a member can see what a drug costs in their plan design, the cost of available alternatives or fulfillment options, and can even switch to a lower-cost option in one click.

Both can be defined as “transparency,” but the tool on the right actually exceeds 2024 requirements. Think of it as the difference between mere compliance and transformative transparency.

Federal agencies have granted more time to get to the first step, but employers can reach the ultimate destination and realize the benefits sooner than the Transparency in Coverage rules require. Not by trying to tackle transparency on their own, but by partnering with the right innovators and transparency solutions right now.

—

Need more content and context on federal transparency rules? Check out these helpful resources to help you stay ahead of the game.